CAN YOUR ECOMMERCE WAREHOUSING WITHSTAND THE PANDEMIC & Q4 ONSLAUGHT?

Let’s zoom in on your warehousing strategy.

Efficient cross border movement of goods during Q4 calls for a flexible strategy to achieve a balance between logistical cost and supply lead time. Through our consultation withs global ecommerce brands manufacturing out of China and Asia, we recommend 3 different warehousing strategies to be adjust for the headwinds that the pandemic and Q4 brings to cross border ecommerce fulfillment

Strategies 1 & 2 are applicable to all ecommerce brands, strategy 3 is a niche strategy catered to ecommerce brands whose SKUs exceed a specific RRP to volumetric weight ratio

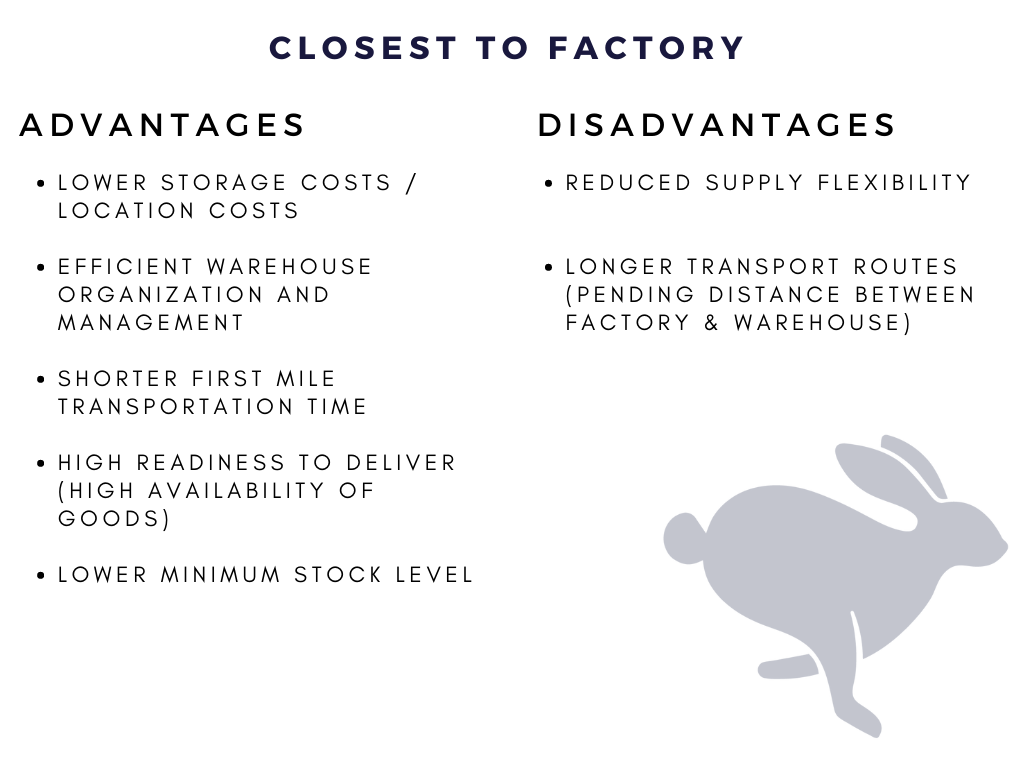

STRATEGY 1: CLOSEST TO FACTORY WAREHOUSING

A JIT inventory model with a backup warehouse nearest to manufacturer mitigates the risk of overstocking inventory at overseas warehouses. Based on sales projections, ecommerce sellers can bulk ship inventory to their overseas warehouses and can utilise a back-up warehouse close to the manufacturer to manage safety and reserve stock.

When actual sales in overseas warehouses exceed projection, smaller order batches can be received from the factory and delivered quickly to the backup warehouse. From there, orders can express couriers for sub 3 days global shipping.

By synchronizing a warehouse closest to manufacturer and express courier, this hybrid strategy reduces the supply lead time and the last mile delivery time. This strategy can be extremely useful during Q4 2021 as multimodal transportation and port terminals experience massive backlogs.

If you are manufacturing in China, then Hong Kong makes logistical and geographical sense for a back up warehouse. As my colleague Romain explains in his article Global Ecommerce Fulfillment From Hong Kong: An Introduction, ecommerce brands with Chinese manufacturing have the opportunity to access 250 global locations and greater choices of shipping options and carriers, from postal to express to consolidated. Simply put, through Hong Kong, ecommerce brands have better shipping lanes to Asia, North America, Europe & Oceania at extremely competitive rates.

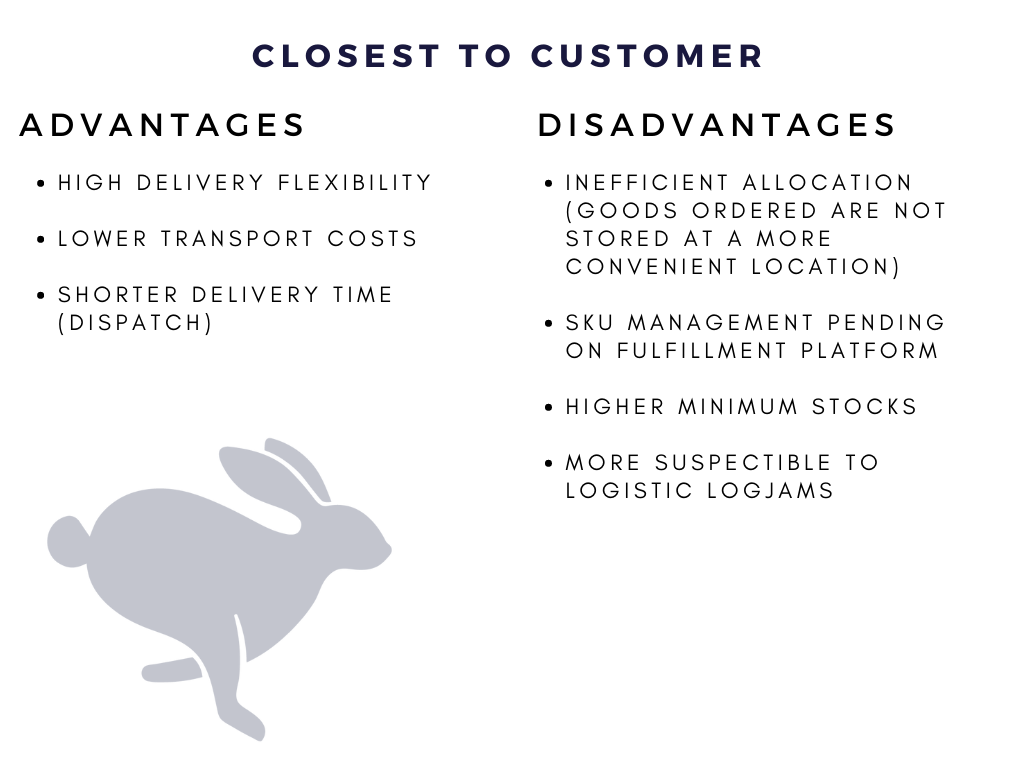

STRATEGY 2: CLOSEST TO CUSTOMER + FACTORY (HYBRID) WAREHOUSING

The pareto principle applies for ecommerce revenue – 80% of revenue come from 20% of markets, the remaining 20% comes from 80% of the markets. The correct fulfillment strategy here is to develop a very strong warehousing strategy for the top revenue generating markets but establish a supply chain setup that monetizes the lesser countries.

The deciding factor behind this strategy deployment is your order volumes. Historically, Floship has only recommended a closest to customer + closest to manufacturer warehouse split when the closest to customer warehouse processes monthly order volumes in excess of 5,000

Deploy a closest to customer warehouse strategy for the geographic markets with 80% of your revenue. If US and/or EU dominate your sales, then deploy a decentralised warehousing strategy that is nearest to your customers will help cut down the cost and time for your last mile delivery. In additi

on, If you also have geographically interspersed markets selling in the range of 1000-3000 orders per month, then also create a centralised warehouse located closest to the supplier/manufacturer.

A hybrid fulfillment strategy is best managed by a single 3PL that can provide global multi-warehouse solution and real time visibility on the SKU quantities in each warehouse and plan the optimal transport routes and carriers.

STRATEGY 3: HYBRID SUPPLY CHAIN BY PRODUCT VALUE

This strategy segments your products into buckets based on the high or low value and follow a different fulfillment strategy for each bucket:

Low value product – RRP/cost of freight <4

High value product – RRP/cost of freight >4

pro tip: an industry insider rule of thumb is if the retail price of the product is more than 4x the cost of freight, then it makes sense to use an express courier.

What does this mean?

For low value products (low cost to weight ratio), shipping cost is one of the major factors that determines how well the product will sell in the market so a closest to customer fulfillment strategy would be advisable, whereas for high value products (high cost to weight ratio) a closest to factory fulfillment strategy can have a lot of benefits especially during the peak season sales.

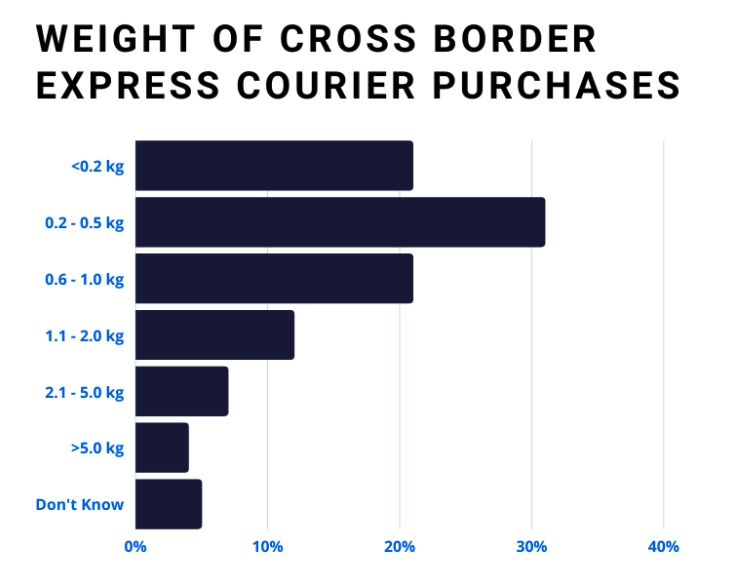

Economically, express courier is best suited for ecommerce categories such as pharmaceutical, high-tech electronics, fashion & apparel and personal healthcare products. The common ground for these product categories is a high cost to weight ratio, sharing the same high retail price items that are below the 2kg weight threshold.

For US ecommerce sellers manufacturing in China or South East Asia and with target market in US, the JIT production mode coupled with express courier option enables products to be shipped directly from a fulfilment center in China or Hong Kong to the US within 2-3 working days.

Tushy as a proof of concept on how this works to both improve the supply chain and keep their end customers happy. Let’s have a look at how we restructured their warehousing and supply chain model to reduce lead time and and delivery cost:

BEFORE:

Production wise, it takes their Chinese manufacturer 20 days to create a batch of 1000 units, prior to Floship, this quantity was bulk imported via ocean freight into to the US, where 80% of their online revenue is happens. Now, the inventory reaches their US fulfillment centre where the orders are finally delivered to the end user. This end to end supply chain cycle takes anywhere between 40-50 days depending on the shipping mode used for the first mile (bulk inventory) and the last mile (orders to the customer’s door).

AFTER:

Rather than directly exporting from their Chinese manufacturer, we moved the products from China to Hong Kong, a process that takes 2-3 days from the supplier to the Hong Kong fulfillment centre, not only did we reduce the first mile time, but as importantly, we also reduced their customs and duties as Hong Kong imposes zero duties and taxes on Chinese imports. From Hong Kong, we leveraged its status as the world’s largest air-freight hub and shipping lanes to deliver the products to their global customers within 3-5 working days. When you factor out the 20 days of manufacturing time, we managed to reduce the end to end fulfillment cycle from 20-30 to 5-10 days.

HOW FLOSHIP CAN HELP

As a cross border logistics company, Floship’s account management and consulting arm will work with your ecommerce brand to create the optimal warehousing strategy factoring in your order volume, origin of manufacturing, global customer base and more. The end goal is to create a streamlined cross border ecommerce supply chain that accounts for operational cost, shipping cost and delivery time to customers in 180 countries and 250 regions.

Does your current 3PL provide you with a global warehousing network and strategic consulting to maximise your operational efficiency? Speak to a Floship consultant on how we can improve your Q4 (and beyond) supply chain!

Ready To Upgrade Your Logistic Solution?

Speak to Floship ecommerce logistic consultant about improving your global support chain today